Colorado flood insurance costs — to secure high flood insurance in Colorado in 2025, there needs to be a deliberate move from reactive to proactive management. The fact is that while land is being developed at a rate that outpaces drainage systems in places such as the Front Range and Pikes Peak region, the inescapable truth is that if there is rain in one area, there can just as easily be a flood in a completely unrelated region, even if it is miles away from the banks of a body of water such as a river..

Whatever your needs happen to be in securing a new loan or examining the existing “Coverage A” structure in place for your property, understanding how FEMA’s Risk Rating 2.0 program affects the private sector is fundamental to developing a sound financial strategy for protecting your future from the very real danger posed by floods.

Deciphering Colorado Flood Insurance Costs via FEMA Mapping

The primary driver of your Colorado flood insurance costs is how the federal government and private carriers view your property’s vulnerability. FEMA’s Flood Insurance Rate Maps (FIRMs) remain the industry standard, but they are increasingly supplemented by high-resolution digital topography and real-time precipitation data.

- The SFHA Factor: If your property is located in a Special Flood Hazard Area (SFHA), such as Zone A or AE, your lender will require coverage before issuing your loan.

- Low-to-Moderate Risk Myths: Don’t get complacent with your “low-risk” areas of B, C, or X. Almost 25% of the general flood claims from the 2025 cycle have come from such zones.

- Elevation Certificates: In Colorado’s mountainous terrain, obtaining an Elevation Certificate from a registered land surveyor can sometimes prove your home is above the “Base Flood Elevation,” potentially slashing your premium.

The Private Market Shift for Colorado Flood Insurance Costs

In 2025, the private insurance sector has emerged as a powerhouse for managing Colorado flood insurance costs, often outperforming the National Flood Insurance Program (NFIP) in terms of both pricing and flexibility.

- Competitive Pricing Models: Private carriers use AI-driven modeling that can offer rates 20% to 50% lower than the NFIP for homes in moderate-risk areas.

- Higher Dwelling Limits: While the NFIP caps building coverage at $250,000, private policies in Colorado can extend to $1 million or more, which is essential for the state’s soaring median home prices.

- Loss of Use Coverage: Unlike federal policies, many private options include “Additional Living Expenses” to pay for hotels and meals if a flood displaces your family—a vital safety net for your personal budget.

Mitigating Urban Runoff to Reduce Colorado Flood Insurance Costs

Because of the rapid growth of cities, areas of “impervious cover,” where water cannot penetrate the ground, have developed, and the result is damaging “[f]lash flood[s]” occurring unexpectedly in residential areas.

- Green Infrastructure: Installing rain gardens, swales, or permeable pavers can also be effective in managing water at the site itself rather than allowing the water to accumulate around the foundation of an existing home.

- Clogged Gutters & Drainage: In Colorado, a water damage claim can be denied if water enters the home because of a homeowner maintenance issue, such as clogged gutters. Keep yard grades moving away from the home.

- Community Rating System (CRS): A large number of cities in the State of Colorado, such as the city of Boulder or Douglas County, are part of the CRS flood insurance program, which could give you an automatic 5% to 25% discount on flood insurance in the State of Colorado.

Understanding “Replacement Cost” in Colorado Flood Insurance Costs

One of the biggest financial traps for Colorado homeowners is confusing “Actual Cash Value” (ACV) with “Replacement Cost Value” (RCV).

- Structure Protection: Most policies for primary residences cover the dwelling at Replacement Cost, meaning the insurer pays to rebuild it at today’s labor and material prices.

- Contents Coverage: Personal belongings like furniture and electronics are typically covered at ACV (depreciated value) unless you specifically add a “Replacement Cost” endorsement to your policy.

- The 2025 “Total Loss” Mandate: Under recent state guidance following the 2025 floods, Colorado insurers are encouraged to provide expedited upfront contents payments to help families stabilize quickly after a disaster.

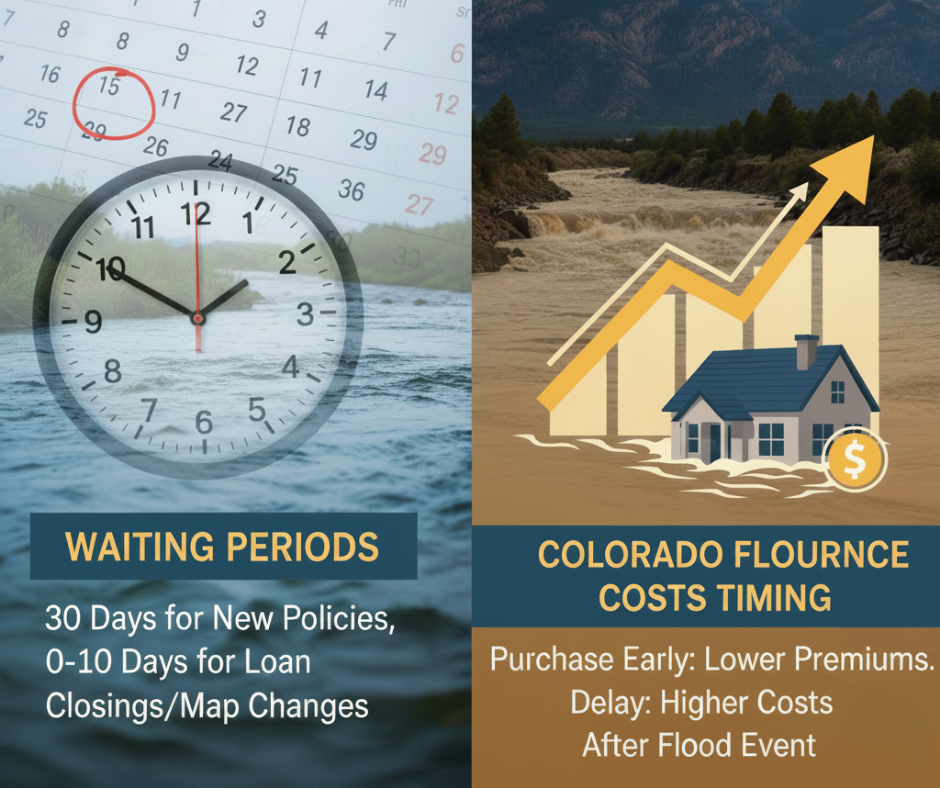

Waiting Periods and Colorado Flood Insurance Costs Timing

Timing is everything when it comes to Colorado flood insurance costs. You cannot wait until a storm is forecasted to seek protection, as carriers strictly enforce waiting periods to prevent “adverse selection.”

- The NFIP 30-Day Rule: Standard federal policies have a 30-day waiting period from the date of the first premium payment before coverage becomes active.

- Private Market Agility: Some private insurers in Colorado offer waiting periods as short as 10 days, or zero days if the coverage is part of a real estate closing or mortgage rollover.

- No Gap Strategy: If you are switching from the NFIP to a private plan, ensure the new policy starts the exact moment the old one expires to waive any new waiting periods.

Legislative Impacts on Colorado Flood Insurance Costs in 2025

The Colorado Division of Insurance (DOI) has been highly active in 2025 to protect policyholders from predatory practices and sudden non-renewals.

- The Model Rebate Reform Act: Agents can now offer value-added mitigation services or tools (up to $250) designed to help you “harden” your home against flood and water damage.

- AI Transparency: New rules require that the “black box” algorithms used to set your Colorado flood insurance costs must be shared with the DOI to ensure they are actuarially sound and non-discriminatory.

- Aerial Imagery Rights: Insurers can no longer non-renew your policy based solely on an old aerial image; you have the right to dispute the accuracy of the photo and provide proof of mitigation.

Colorado Flood Insurance Costs: Manual FAQ Section

1. Is flood insurance required in Colorado?

While not mandated by state law, if you have a mortgage through a regulated lender and live in a high-risk area (Zone A or AE), your lender will require it. However, since 25% of claims occur in low-risk areas, many financial advisors recommend it regardless of your zone.

2. Does my regular home owner’s policy cover basement flooding?

No. Most standard policies in Colorado do not provide coverage for damage from “surface water” or “overland flooding.” You need a separate flood insurance policy or a “Water Backup and Sump Pump” endorsement.

3. What is the average cost of flood insurance in Colorado?

In the low-to-moderate risk regions, the policies can cost as low as $350 or as much as $800 a year. In the high risk regions, the cost can go above $3,000 depending upon the elevation.

4. Can I get flood insurance if I rent a condo or apartment?

Yes. Renters may buy a policy called “Contents-Only” that safeguards home belongings, including furniture, appliances, and clothing, from flood damage often at an incredibly low price.

5. What is “Loss of Use” and do I need it?

“Loss of Use” covers your temporary housing costs if your home is rendered unlivable due to a flood. This is common in private policies but not under the federal program NFIP.

In Conclusion

Optimizing your flood insurance in Colorado in 2025 is a careful dance between playing it safe and playing it smart financially. By leveraging competitive markets, understanding the value of a community-based reduction in insurance rates like the CRS Program, and staying updated on the latest legislation affecting your state’s insurance policies, you can protect your investment property effectively without going broke in the process. The thing to remember if you happen to be a Colorado resident is that it doesn’t take much for a dry basement to become a ‘$40,000 problem.’ One big mountain melt or a spring downpour can do the trick.

For more information on your rights as a Colorado policyholder, visit the Colorado Division of Insurance (External DoFollow Link) or consult with your local independent agent to review your internal policy documents.

Disclaimer: This article is for informational purposes only and does not constitute insurance or legal advice. Please consult with a licensed Colorado insurance professional to discuss your specific risk profile and coverage needs.