Securing significant Colorado home insurance savings in 2025 requires more than just a standard annual renewal; it demands a strategic understanding of the Centennial State’s unique risk landscape and the “Model Rebate Reform Act”. Whether you are facing rising premiums due to high-altitude wildfire risks or looking to optimize your “Coverage A” (Dwelling) limits, being proactive is the key to protecting your budget while maintaining robust coverage. In the current market, simply letting your policy “rubber stamp” itself can lead to costly mistakes and missed opportunities for premium relief.

Harnessing the Power of Policy Bundling for Colorado Home Insurance Savings

To get a deal, on Colorado home insurance one thing you can do is bundle your policies together. This means buying your homeowners insurance and your auto or life insurance from the company. In Colorado insurance companies often give you a discount when you do this, which is called a multi-line discount. This can be a good way to save money on your Colorado home insurance.

• Multi-Policy Discount: Combining home and auto can save you between 5% and 15% on your annual bill.

• Carrier Loyalty: When you are looking for Colorado home insurance it is an idea to shop around. Some insurance companies that you stay with for a long time will give you something called Carrier Loyalty rewards. These Carrier Loyalty rewards can really help you save money on your Colorado home insurance. You can get these Carrier Loyalty rewards if you stay with the company for three to six years. This is a way to save money on your Colorado home insurance with Carrier Loyalty.

• Deductibles: There are some special deals in Colorado that let you have one deductible for both your home and your car. This is helpful if something like a bad hail storm damages both your home and your car at the same time. The Unified Deductibles are a thing to have in Colorado because you only have to pay one deductible for the damage, to your home and your car.

• Group Discounts: In Colorado, memberships in AAA, alumni organizations, or professional trade groups can often trigger additional savings.

Strategic Deductible Adjustments for Maximum Colorado Home Insurance Savings

If you want to save money on your Colorado home insurance you should think about changing your “All-Peril” or “Wind/Hail” deductible. This can make a difference. In Colorado hailstorms happen a lot many insurance companies now want you to have a separate deductible just for wind and hail damage. This deductible is usually a percentage of how much your house’s worth, like one percent or two percent of your dwelling limit.

• Raising Your Deductible: Moving from a $1,000 to a $2,500 deductible can significantly slash your monthly premium by up to 25%.

• Risk vs. Reward: You should make sure you have some money saved up like an emergency fund to cover the costs that you have to pay when you make a Partial Loss claim. This way you are prepared, for the Risk of a Partial Loss claim and the Reward of being safe is that you have money to fall on. When you have a Partial Loss claim the Risk is that you have to pay money but the Reward is that you have an emergency fund to help you with the costs of a Partial Loss claim.

• Claim Forgiveness: When you are looking for insurance policies in Colorado you should look for the ones that have Claim Forgiveness. This is a feature that helps you. It stops your insurance rate from going up a lot after you file your claim with the insurance company. You want to find a Colorado policy that includes this Claim Forgiveness feature so that your insurance rate does not get too high after you make a claim. This way you can file a claim, with the insurance company without worrying about the Claim Forgiveness issue and your rate going up.

• Avoid Small Claims: To maintain your claims-free discount, try to pay for minor damages under $1,000 out of pocket.

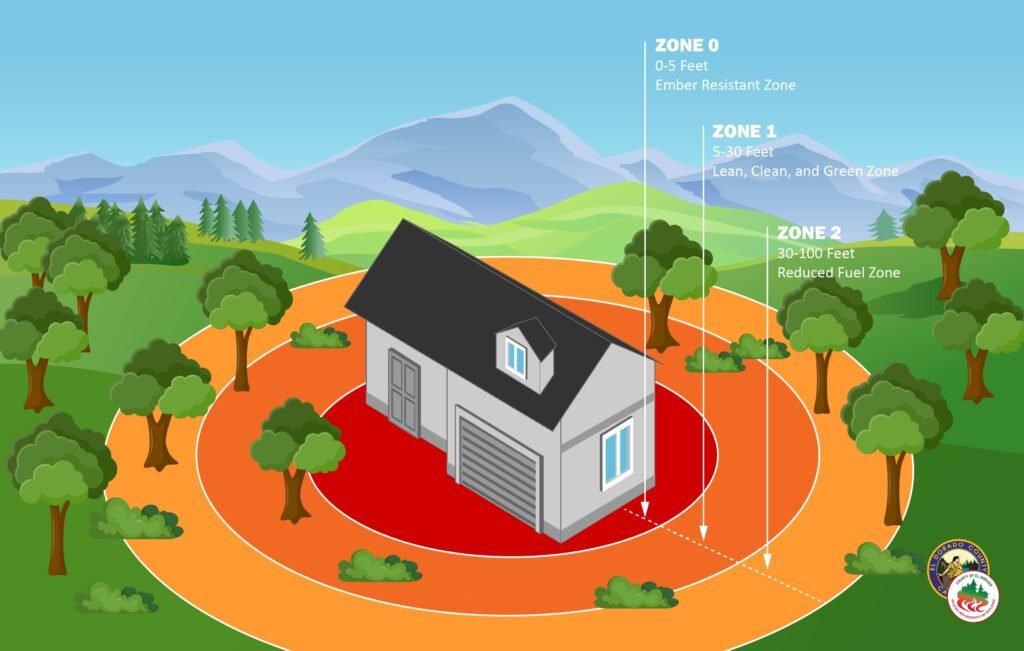

Wildfire Mitigation and Colorado Home Insurance Savings

In the year 2025 Colorado carriers are using wildfire risk models more and more to figure out who is eligible. Making a Space around your property is not just something you do to be safe it is also a way to save money on Colorado home insurance. Colorado home insurance can be expensive. Having a Defensible Space, around your property can really help you save money on Colorado home insurance.

• Mitigation Credits: If you live in an area that’s prone to wildfires you can get Mitigation Credits under HB25-1182. To get these Mitigation Credits you need to make some changes to your home. For example you can install what is called “Class A” fire-rated roofing. You can also install ember- vents. If you do these things you can qualify for verified premium credits for your Mitigation Credits. This is a thing to do if you want to save money on your insurance premiums, for your Mitigation Credits.

• Community Programs: When you take part in fire-wise community programs you can get extra discounts from the community programs participating insurers, the community programs. This is because the community programs help people and the participating insurers of the community programs like that. The community programs are a thing so the participating insurers of the community programs give discounts to people who are, in the community programs.

• Lifestyle Factors: Not smoking is really important. If you used to smoke but you quit you should tell your agent. This can help you save money on your home insurance, in Colorado.

• Legislative Protections: Under recent Colorado laws (HB 25-1322), you have the right to request a certified copy of your policy and any aerial imagery used to determine your risk rating.

Modernizing Home Systems to Boost Colorado Home Insurance Savings

Older homes in Denver or Colorado Springs often carry higher risks for “Direct Physical Loss” due to outdated infrastructure. Updating your home’s core systems is a “win-win” for safety and Colorado home insurance savings.

- Electrical & Plumbing: Replacing knob-and-tube wiring or installing “Smart Water Shut-off” valves can earn you significant credits.

- Roofing Upgrades: Investing in impact-resistant shingles (UL 2218 Class 4) is one of the most effective ways to lower your premium in Colorado’s “Hail Alley”.

- Protective Devices: Hard-wired smoke detectors and monitored security systems provide “Protective Device” discounts.

- Active Detection: Advanced systems that automatically shut off water or gas leaks can lead to even deeper discounts on your annual bill.

Understanding Coverage Categories for Colorado Home Insurance Savings

When you want to save money on your Colorado home insurance you need to know about the Declarations Page. This is where you can see how your insurance is split up. You should not pay for things that cannot get damaged. That are not worth much anymore. You need to look at your Colorado home insurance and make sure you are not paying for things you do not need. The Declarations Page is very important, for your Colorado home insurance savings.

• Coverage A (Dwelling): You should make sure you are insuring your home for the cost to replace it not for how it is worth, on the market. Do not include the value of the land when you are figuring out how insurance to get for Coverage A (Dwelling). This way you will have money to rebuild your home if something happens to it.

• Coverage C, which is Personal Property has a rule in Colorado. If your main home is a loss the insurance company has to give you at least thirty percent of your Coverage C upfront. They have to do this without you making a list of everything you lost. This is really helpful because you get some money away to help you deal with the loss of your personal property, which is what Coverage C is, for.

• Additional Living Expenses (ALE): The law, in Colorado says that you have to have least 12 months of Additional Living Expenses coverage if you have a replacement-cost policy. This helps you with Additional Living Expenses when you have to pay for a place to live if your home is badly damaged and you cannot live there.

• Personal Property Review: Reassess the value of your possessions annually; removing coverage for items that have lost value is a simple path to Colorado home insurance savings.

The Final Steps to Colorado Home Insurance Savings

Reviewing your policy annually with a licensed agent is the final, essential step. Avoid “rubber stamping” your renewal, as your home’s value and your personal “Insurance Bureau Score” (IBS) change every year.

• Shop You should always get at least three quotes for the same coverage. This way you can be sure you are getting the deal in the current Colorado market for the insurance you want. Shop Around for insurance is very important to save money. When you Shop Around you can compare the prices of companies, in Colorado.

• Digital Payments: A lot of companies in Colorado are now charging people to send in payments by mail. If people switch to electronic deductions the companies can save money on things, like paperwork and staff time. This is because Digital Payments are a lot easier to handle. With Digital Payments companies do not have to spend much on administrative costs.

• Claim Preparedness: Take pictures of your home so you have proof of what you own. This way if something happens you can show these pictures to get the money you should get from your insurance company. It is an idea to do this so you can get the full amount of money from your Claim Preparedness when you need it.

Colorado Home Insurance Savings: Manual FAQ Section

1. Do people have to get homeowners insurance in Colorado because the law says so?

No the law, in Colorado does not say that people have to do it. Almost all the companies that give mortgage loans want people to have a policy. This is so the mortgage lenders can protect the property that they have loaned money on which’s their collateral the mortgage lenders want to protect their collateral.

2. What does the Model Rebate Reform Act do to my money that I have saved. The Model Rebate Reform Act is a law that can change how money I get to keep from my savings. So how does the Model Rebate Reform Act really affect my savings.

The law that starts in 2025 in Colorado says that Colorado agents can give you things or gifts that are worth, up to $250. These things are meant to help you deal with losing things on your property. This can also help lower the costs you have to pay over time. The Colorado agents do this to help you with your property.

3. What is the difference between “Actual Cash Value” and “Replacement Cost” in Colorado?

When you have something that is damaged you can get money for it in two ways. “Actual Cash Value” is one way. This is the value of your thing after it has gotten older and is not worth as much as it used to be. On the hand “Replacement Cost” is the amount of money it would take to buy a brand new thing to replace the one that is damaged so you get the full value of a new item to replace your damaged belongings.

4. Does my credit score have an impact on the cost of my home insurance, in Colorado?

In Colorado most insurance companies use a score to figure out how much you pay for insurance. This score is based on your credit. So if you want to save money on your home insurance in Colorado you need to have credit. Good credit is really important if you want to get a deal, on your Colorado home insurance. Colorado home insurance can be expensive. Good credit can help you save money.

5. Does the kind of dog I have change how much I pay for insurance? My dogs breed is something I am wondering about when it comes to my premium. Will my dogs breed really affect my premium?

In Colorado, certain breeds may cause an insurer to cancel coverage or increase rates; however, providing proof of obedience training can sometimes mitigate these increases.

In conclusion getting a deal on Colorado home insurance is something that you have to work at. You have to look for discounts in your area and know about the rules in Colorado like the “Law and Ordinance” coverage, which’s at least 20%. You also have to take care of your property so it can withstand things that can happen in Colorado.

If you do these things every year like looking over your home insurance in 2025 you can make sure your home is safe, without spending much money on Colorado home insurance. This way you can protect your Colorado home, which’s probably your most valuable thing and you can do it without going over your budget for Colorado home insurance.

For more information on Colorado-specific rights, visit the Colorado Division of Insurance or consult with your local agent to find internal policy documents.

________________________________________

Disclaimer: This article is for informational purposes and does not constitute legal or insurance advice. Please consult with a licensed Colorado insurance professional for your specific situation.